What People Are Saying About The New W-4

On June 5, the Internal Revenue Service (IRS) published a draft of the 2019 W-4 for public commentary.

Summarize with AI:ChatGPTPerplexity

On June 5, the Internal Revenue Service (IRS) published a draft of the 2019 W-4 for public commentary. Payroll professionals have taken to various mediums to voice their opinions on the federal withholding form. The IRS hopes to have a finalized version by the end of August, after taking the public’s comments into account;

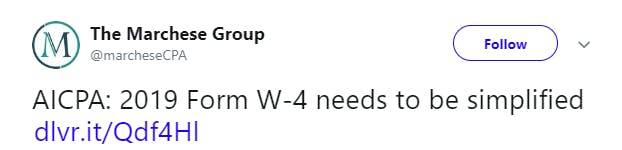

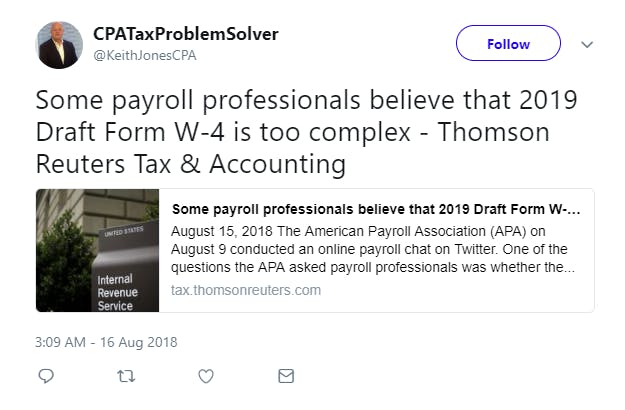

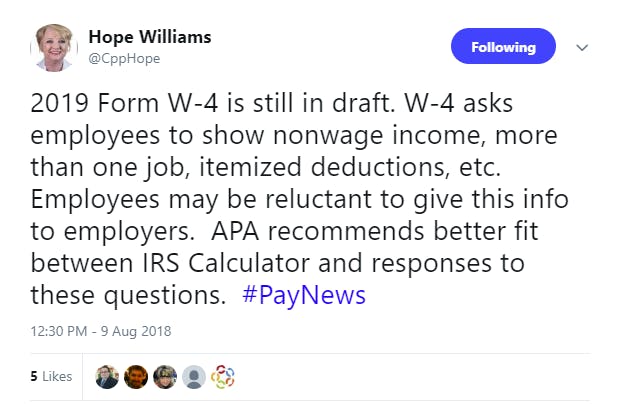

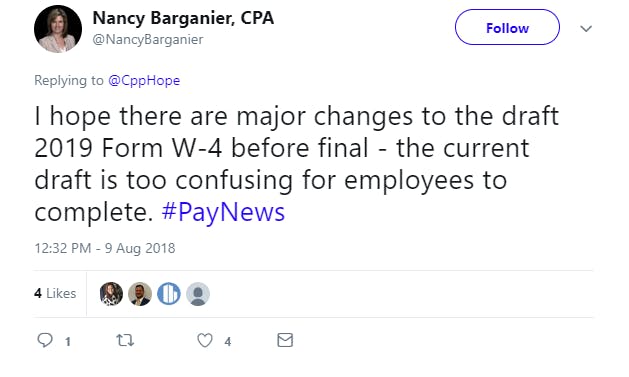

Here are a few snapshots of reactions to the 2019 draft Form W-4.

Some thoughts from Twitter:

On PayrollTalk, Symmetry Software’s community of payroll professionals, there were multiple discussion threads on the W-4.

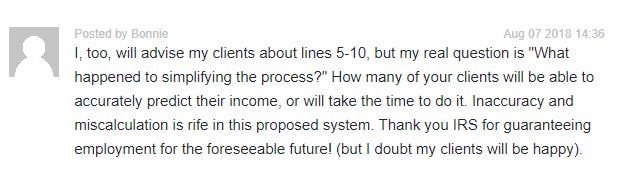

CPA Advisors blog comment:

Keep reading: related insights

Guides and tools

Future-Proof Your People Tech Platform For 2026 Automating Form I-9 Verification: A Guide for HR Tech, Payroll, and Onboarding ProvidersBuild, Buy, or Blend? Finding the Right Payroll Tax Infrastructure for GrowthSolving Tax Compliance Challenges For Payroll ProductsChoosing the Right Tax Compliance API for your Payroll ProductThe Buyer’s Guide

to Payroll Tax EnginesFringe BenefitsPayroll Tax Geocoding GuideLocal TaxesMulti-State PayrollSalary calculatorSymmetry client stories

Latest articles

Highly Compensated Employees, Wage Bases, and the First Payroll Mistake of the YearWhat Payroll Teams Expect in January and How They Judge Your PlatformWhy the New Year Exposes Payroll System Weaknesses (And How to Prevent Risk)Tax Logic AI: Instant Payroll Transparency2026 Payroll Tax Changes: Compliance Guide for Payroll PlatformsTop Payroll Conferences For People Tech Platforms in 2026Beyond Compliance: Automated I-9 Verification as a Growth Engine for HR Tech Providers