Intelligent & realtime payroll tax explanations

Symmetry’s latest payroll innovation, Tax Logic AI, is your 24/7 AI tax research expert that eliminates the costly support cycles spent manually researching complex payroll tax calculations. Available now, for Symmetry Tax Engine® (STE) clients!

Unlock the benefits of instant tax expertise

- < 1 minTax calculation explanations

- 98%Faster support resolution

- 74%Deflected support tickets

Clear and concise tax interpretation for complex payroll calculations

Reclaim valuable resources

Automate time-consuming tax research, enabling your compliance and technical teams to reclaim focus on product innovation with realtime tax expertise.

Complex tax calculation clarity

Give internal teams and clients unprecedented payroll transparency on how every complex tax calculation was performed, ensuring full confidence.

Accelerate team expertise

Rapidly empower new support agents and analysts with instant access to exact tax logic, transforming complex questions into confident, immediate answers.

Elevate client experience

Get 24/7 access and reduce support resolution time from weeks to minutes. Significantly reduce support volume. Fewer tickets. Better experience.

Audit-grade clarity

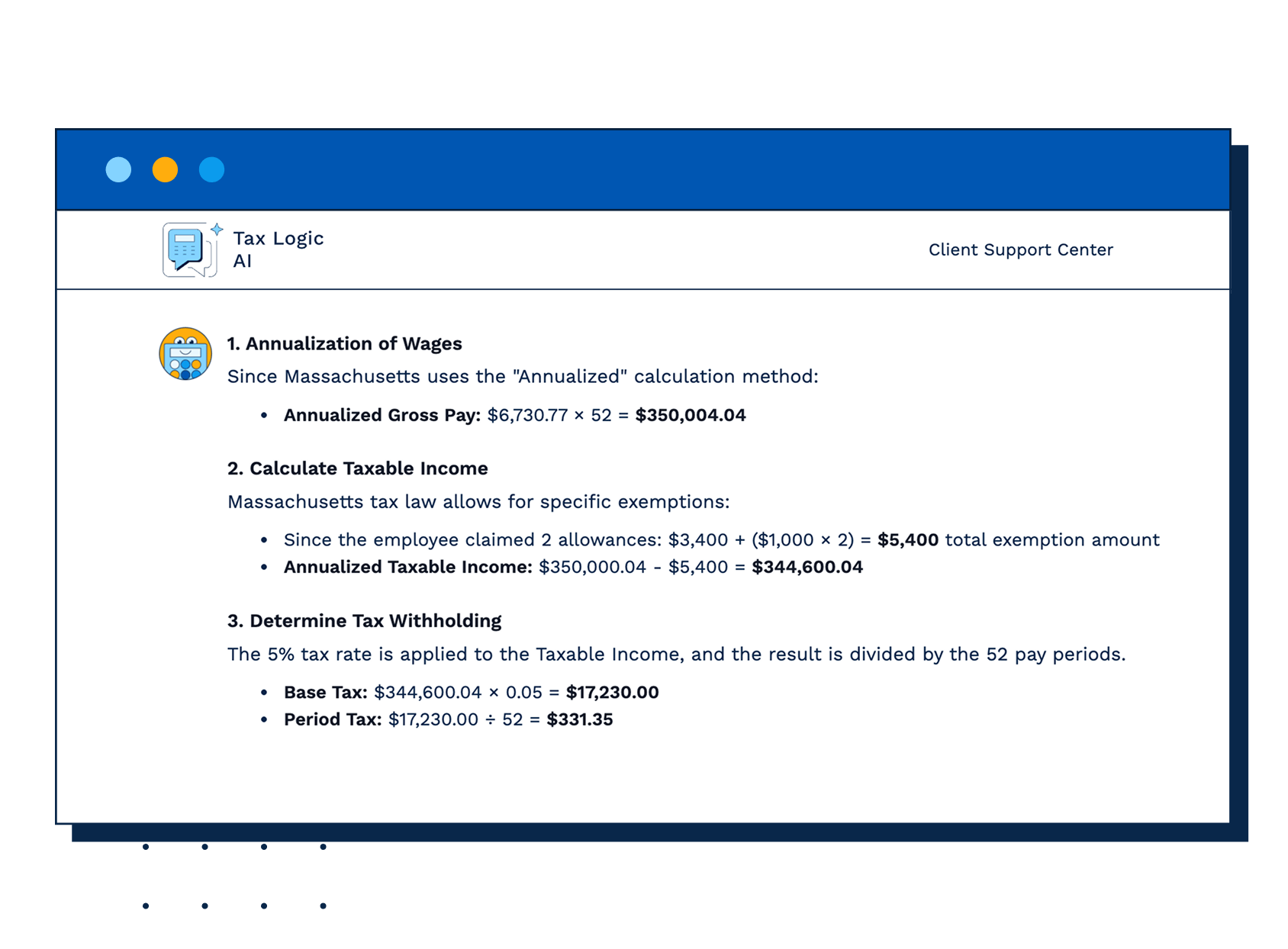

Provide clear, step-by-step explanations of the final tax calculations, turning any complex inquiry into a full forensic analysis.

Data privacy & security

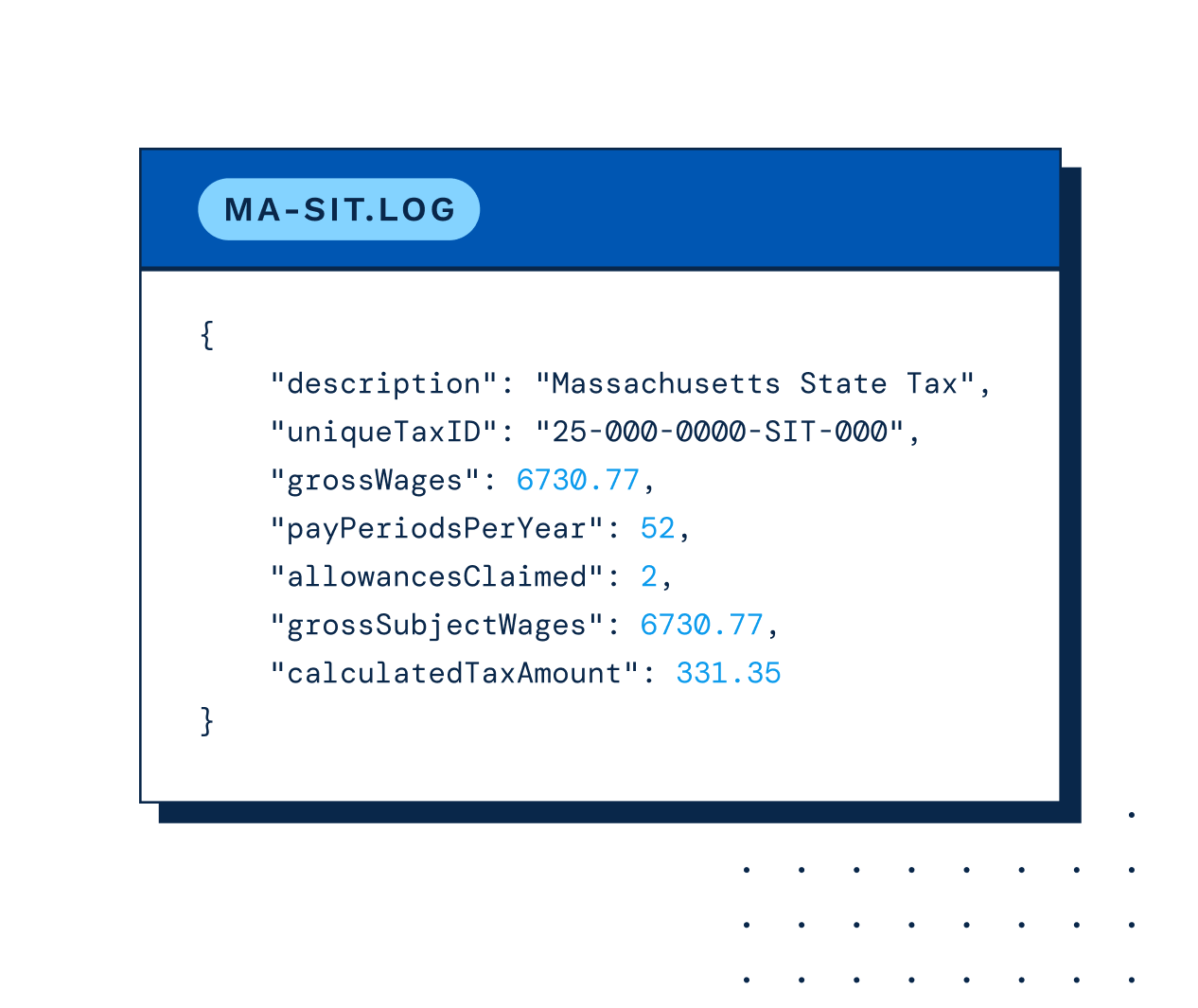

No storage of personal data. The AI platform processes log file payloads via encrypted communications.

Intelligent, realtime tax explanations — here’s how it works

The Symmetry Tax Engine® (STE) delivers the right payroll calculations, Tax Logic AI provides step-by-step tax logic explanations. Our intelligent AI platform is designed to provide clear and concise tax interpretation for complex payroll calculations, offering you realtime access to Symmetry’s tax expertise.

Tax Logic AI for compliance & technical teams

The experts speak: how AI transforms manual tax research into realtime compliance confidence.

Product director at a top payroll providerTax Logic AI is a nice feature that provides very quick feedback and helps us debug complex issues and identify bugs, helping us rapidly diagnose everything from parameter errors to user misinterpretations, ultimately increasing our productivity and reducing the need for support requests.

Tax compliance expert at a vertical payroll platformThe AI agent is a real benefit for handling tax scenarios and state reciprocity, as it cuts our research time down significantly by immediately spelling out calculations, helping us quickly check configurations, update employee profiles, and correct client information much faster than submitting a support ticket or tedious testing in Postman.

FAQ

Contact us if you don't find your question answered here about Tax Logic AI.

Get started

Looking for more?

Symmetry Tax Engine

Calculate gross-to-net payroll taxes to build or enhance a payroll product, embed payroll into an existing application, and increase compliance.

Symmetry I-9

Fast, compliant I-9 verification software for onboarding and payroll providers. Offers all Section 2 verification methods (including remote) and full E-Verify integration.

Symmetry Payroll Point

Determines complicated local withholding tax rates within your product by applying latitude and longitude coordinates of a residential address and a work address against Symmetry’s expansive library tax shapefiles, nexus and reciprocity algorithm.