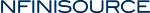

Online withholding forms for automated employee onboarding

Symmetry Payroll Forms (SPF) automates employee onboarding and new-hire tax withholding forms. SPF includes over 130 compliant online tax withholding forms for federal, state, and local governments, including resident, nonresident, military spouse, and more. All forms are 100% electronic, regulatory compliant, and auditable for all tax jurisdictions. Available for both U.S. and Canada.

Automated online withholding forms

& tax forms make payroll easier

Symmetry Payroll Forms (SPF) simplifies tax compliance by automatically determining local employee tax rates such as PSD codes, EIT rates, and school districts, and integrating them directy into the appropriate forms. With over 130 automated and compliant online withholding forms from federal, state, and local governments, SPF ensures seamless employee tax withholding process.

Compliant Withholding Forms

- Follows audit guidelines.

- Rulings requested and provided from all 50 states and U.S. territories.

- Conforms to IRS Publication 15A, Regulation section 31.3402(f)(5)-1.

- Automatically applies nexus and reciprocity through Symmetry’s multi-state wizard.

Secure Data

- No storage of personal data such as names, social security numbers or addresses.

- The hosted web application option has HTTPS and SAML security features.

- Native security/authentication.

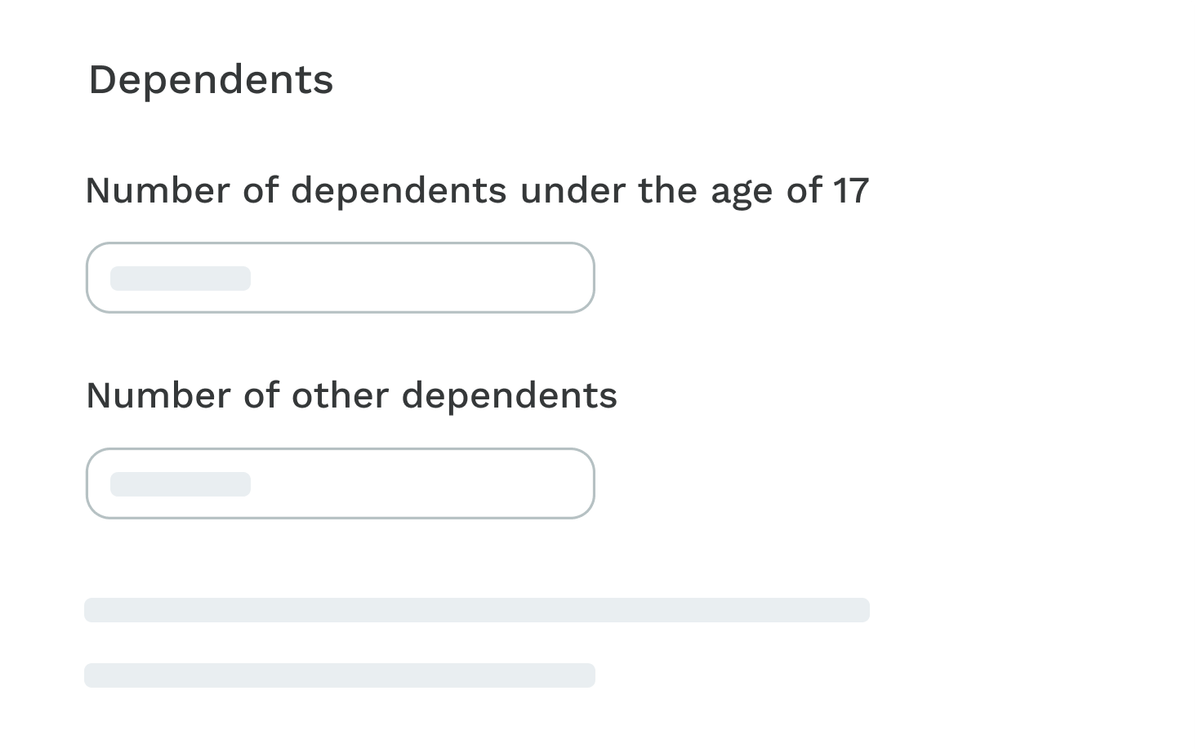

Get structured, consistent payroll data

Employee enters data manually or employee data is loaded via JSON from internal systems.

Users have a choice between Guided Mode or Choose Mode. This decision can be made at the company level.

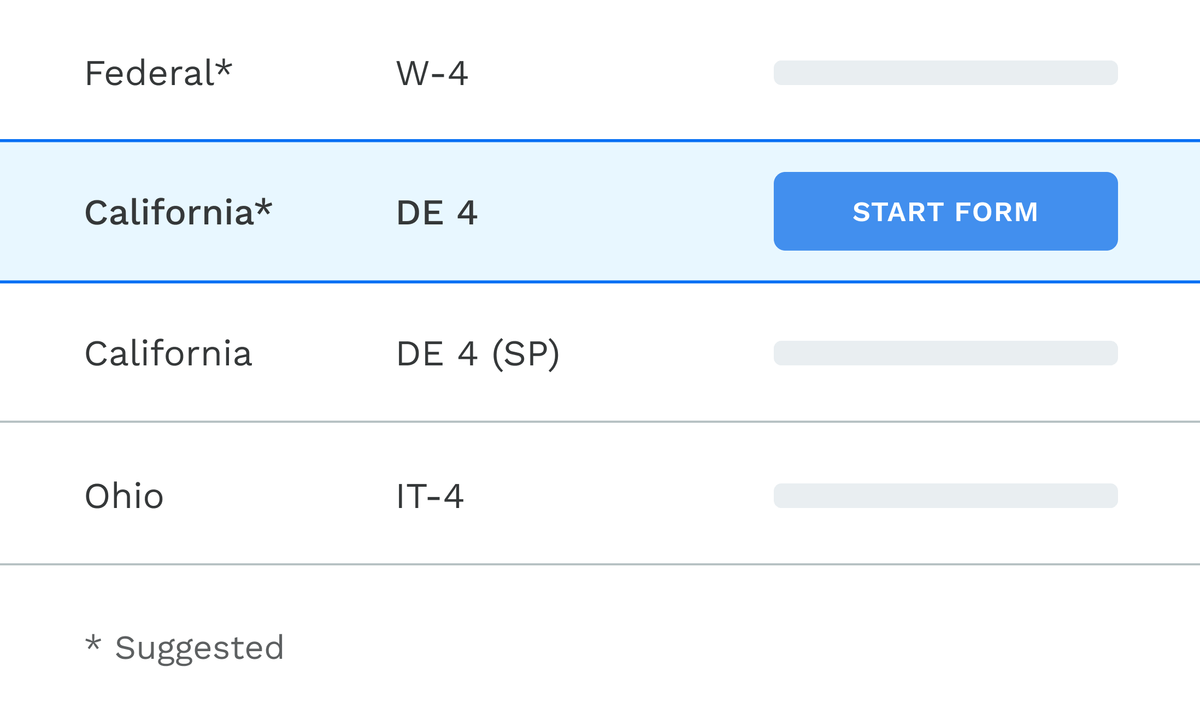

SPF identifies correct forms employees need to fill out based on location and individual circumstances.

Employee is walked through necessary forms needed — providing jurat statements to ensure compliance.

Completed payroll forms are sent back to HR/Payroll department.

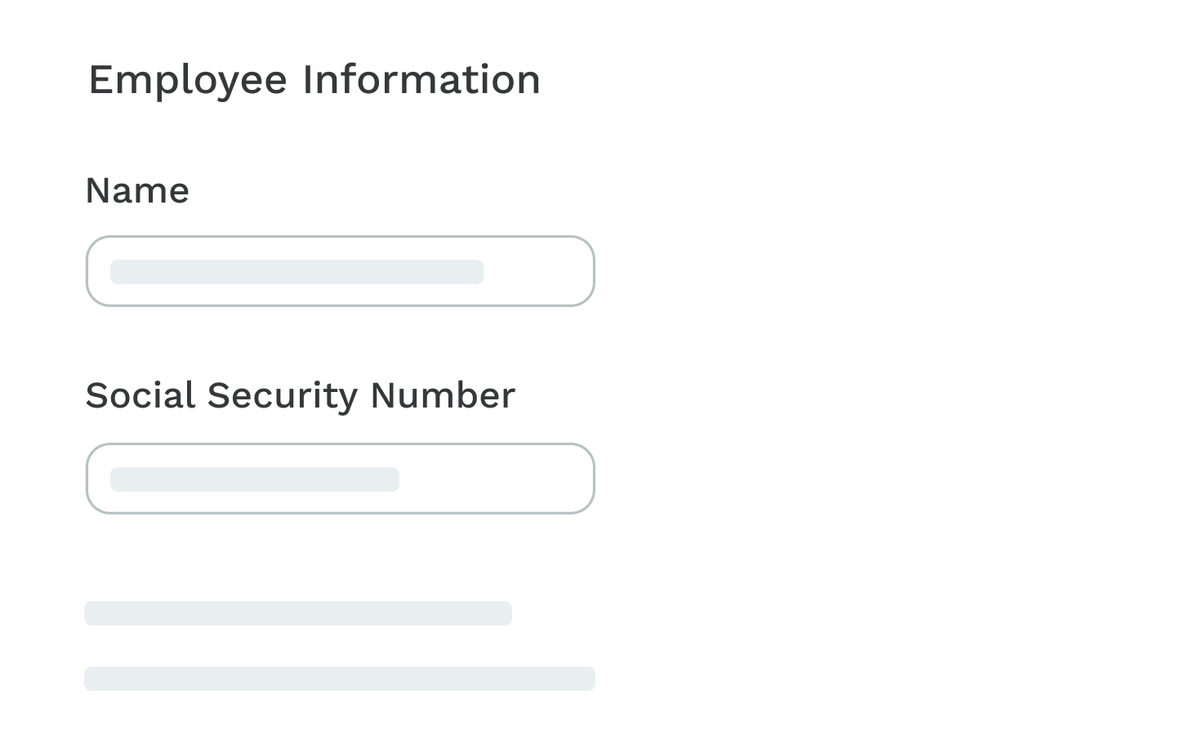

Guided vs. Let Me Choose

Simplify your employee exemption certificate procedure with the option of two paperless processes.

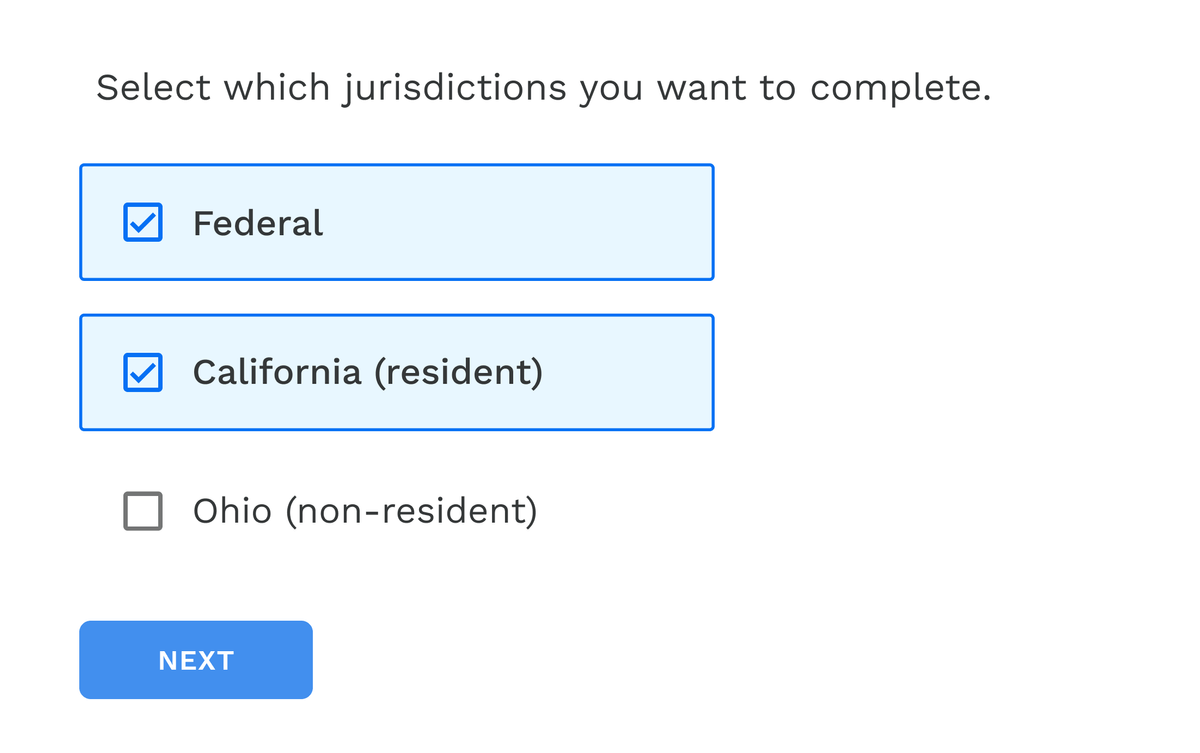

Guided employee onboarding interface

Ideal for new hires — employee onboarding — employees are coached through an automated process on what information to provide and where to provide it.

- Ensures forms submitted by an employee are correct and complete.

- Guides employees to the necessary forms based on their responses to questions generated from their home and work addresses in the “Guided” process.

- Employees get a simple and smooth process while employers get all the information they need to set up withholding accurately.

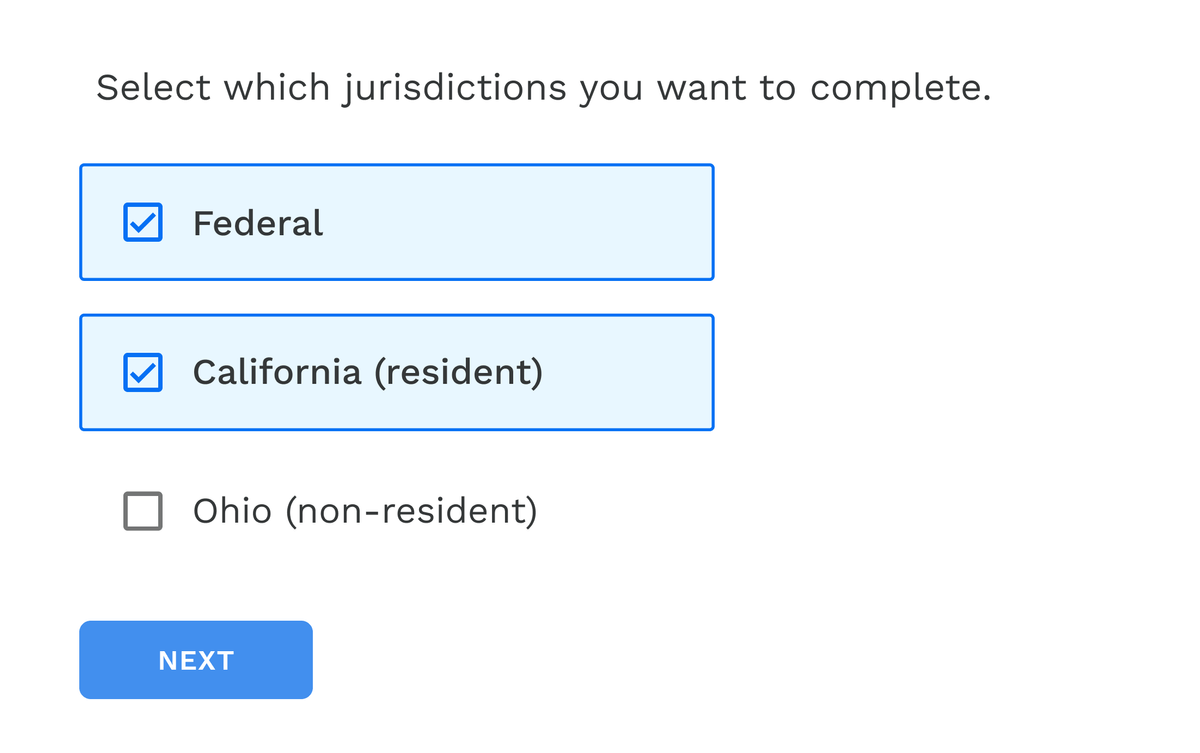

Let Me Choose interface

Ideal for companies and employees who know the exact forms they need — gives employees the ability to select forms at will.

- Displays all relevant forms based on the employee’s work and home address.

- Allows employees to select the withholding forms they would like to complete.

- Field validation ensures employees complete forms accurately.

Who will love it?

"We have been providing onboarding to the federal government for the past 12 years and our biggest pain point, by far, was maintaining the W-4 tax forms. With Symmetry Software’s product, we no longer have that problem!"

"Symmetry has allowed us to simplify the hiring experience with the Symmetry Payroll Forms API. We have seen great feedback and results."

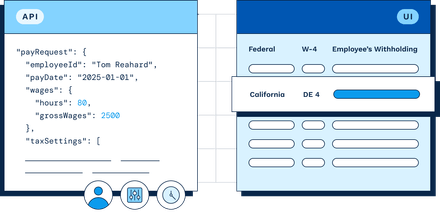

Two versions to fit your needs

Symmetry Payroll Forms offers flexibility with two implementation options: an easy-to-use API or a customizable Web Application.

Both versions provide the same compliant forms product. The difference lies in deployment, testing, and customization. The Web Application allows you to receive transactions via postback, email them, or print them out. The API integrates into your system, fitting seamlessly with your existing processes.

| Feature | API recommended | Web Application |

|---|---|---|

| Deployment | Build your own user interface experience into your application with the Payroll API. | Symmetry Payroll Forms embeds on your website or stands alone on an independent website. |

| Customization | Your team builds custom user flows within your application with the easy-to-use API. | Customize the application to fit your brand. |

| Updates | Symmetry Payroll Forms updates are automatically applied with no action on your part. | |

| Regulatory compliance | Meets withholding audit guidelines at the federal, state, and local level. Conforms to IRS Publication 15A, Regulation Section 31.3402(f)(5)-1. | |

| Technical specifications | Returns all tax parameters via JSON to input into your payroll system. Includes PDF forms encoded in base64. | |

Nexus and reciprocity

SPF considers nexus and reciprocity when determining what forms to present. The multi‑state library has all state‑to‑state reciprocity agreements built in as well as rules relating to which forms are required based on the employee’s settings and the company’s nexus setting.

The Symmetry Location Service pre‑populates all local tax settings such as school districts and PSD codes.

1Resident state

Determine the resident state.2Nonresident state

Determine the nonresident state.3Reciprocal agreement

Is there a reciprocal agreement between the res. and nonres. state?4Nexus

Does nexus exist in the resident state?

FAQ

Contact us if you don't find your question answered here about Symmetry Payroll Forms.

Get started

Looking for more?

Canadian Withholding Forms

Automates employee withholding form process with 100% electronic and compliant Canadian federal, provincial and territorial TD1 forms.

Symmetry I-9

Fast, compliant I-9 verification software for onboarding and payroll providers. Offers all Section 2 verification methods (including remote) and full E-Verify integration.

Symmetry Tax Engine

Calculate gross-to-net payroll taxes to build or enhance a payroll product, embed payroll into an existing application, and increase compliance.