Payroll Insights

InsightsTax compliance insights to build remarkable payroll products

Payroll Compliance News

Your exclusive quarterly insights: The essentials to payroll compliance.

Looking for more?

Guides

- Future-Proof Your People Tech Platform For 2026

- Local Taxes

- Fringe Benefits

- Multi-State Payroll

- Payroll Tax Geocoding Guide

- The Buyer’s Guide to Payroll Tax Engines

- Choosing the Right Tax Compliance API for your Payroll Product

- Solving Tax Compliance Challenges For Payroll Products

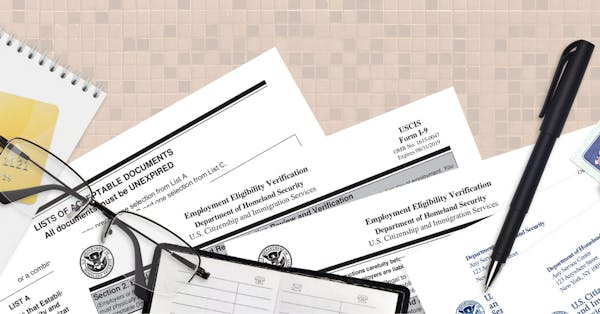

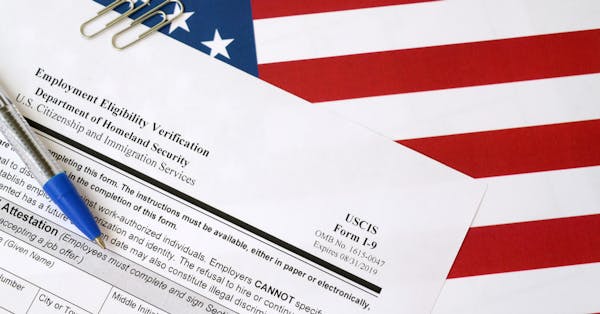

- Automating Form I-9 Verification: A Guide for HR Tech, Payroll, and Onboarding Providers

- Build, Buy, or Blend? Finding the Right Payroll Tax Infrastructure for Growth