Local minimum wage rates for multi-location payroll tax

The Minimum Wage Finder tracks the minimum wage rates across the country by state, city, work or residential address, job type, job function, effective date, and more. Easily embed or integrate employee minimum wage rates into the payroll process.

Quickly identify local minimum wage requirements

The Minimum Wage Finder helps companies ensure employees are paid the minimum wage when appropriate, helping to avoid legal issues and fines by remaining compliant. The Minimum Wage Finder uses the same proprietary technology as the Symmetry Tax Engine with leading-edge mapping technology and geospatial boundary maps for jurisdictions.

1Compensation research

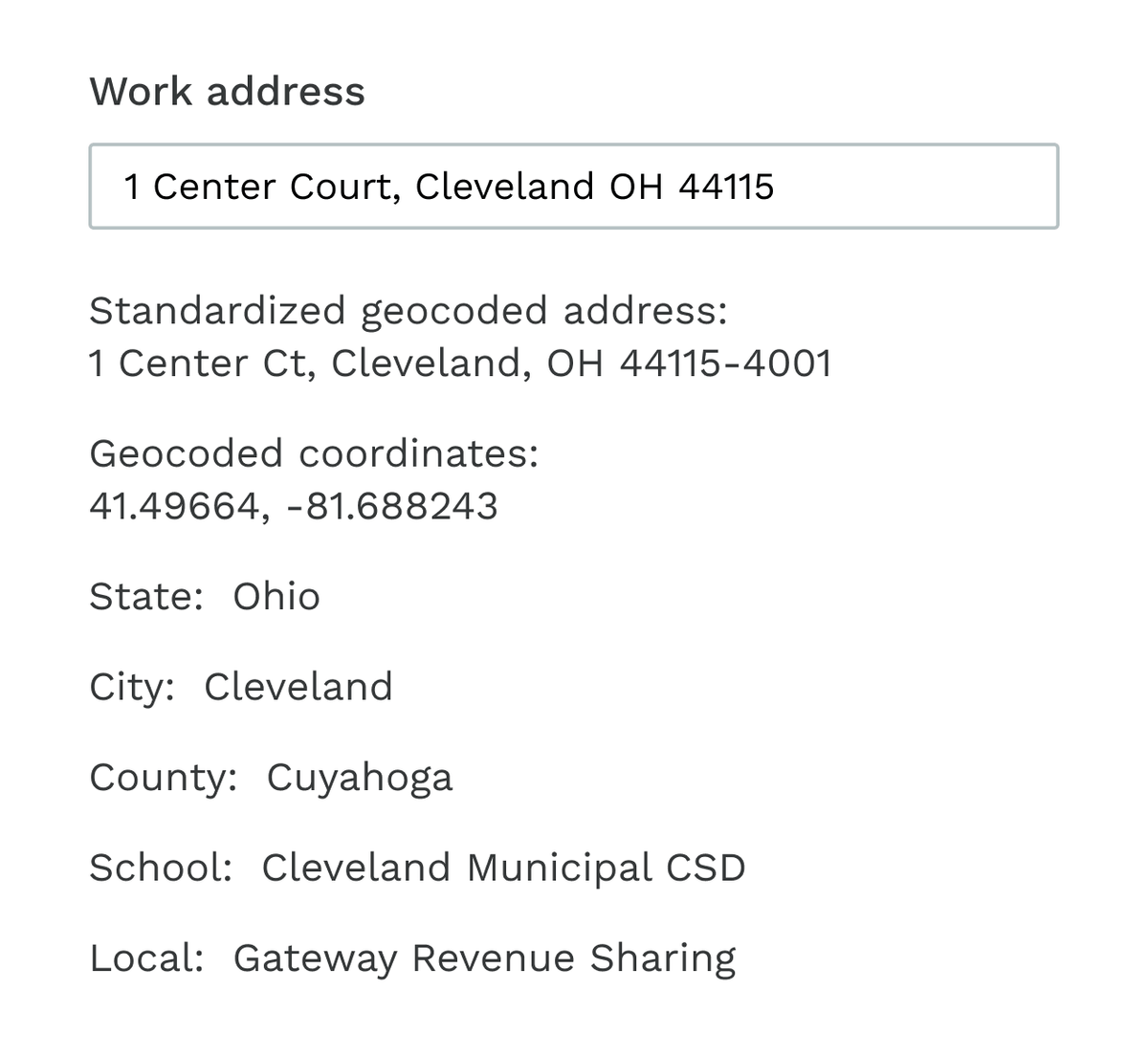

Symmetry’s compensation research experts identify all new minimum wage and rate rules.2Geocoding technology

Our geocoding technology identifies the exact wage requirements using latitude and longitude coordinates.3Accurate wage rates

The Minimum Wage Finder returns all rates associated with the location in question, giving you accurate wages to stay compliant.

Pinpoint wage accuracy

Use exact latitude and longitude coordinates for employees’ work addresses to pinpoint the exact minimum wage rates that apply to individual employees. Also returns any exemption thresholds and additional limits.

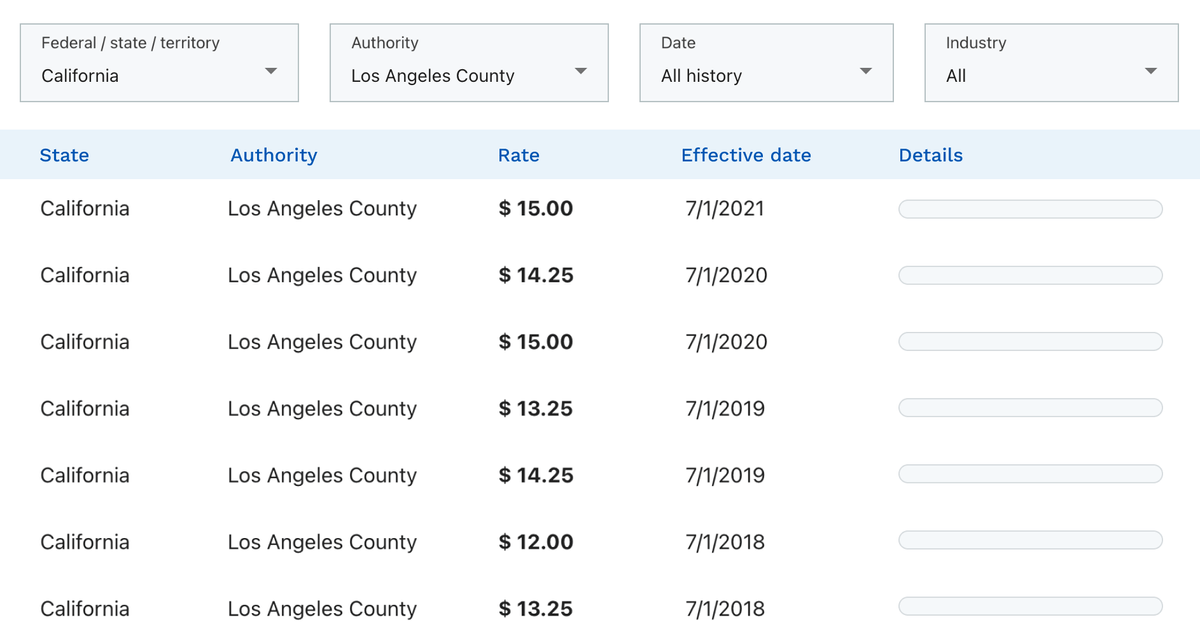

Historical and future rates

Symmetry’s research team keeps track of past, present, and future wage rate changes. Having access to these wage rates allows you to budget the cost of compensation accurately.

Strategic resource planning

Keep up with minimum wage rate increases ahead of time for your strategic compensation forecasting and hiring projection planning purposes.

Insights: Why Every Business Needs a Minimum Wage Finder

Who will love it?

"Symmetry Software had a very detailed integration guide and a phenomenal technical staff that allowed us to get to market much quicker than if we had tried to tackle this on our own."

Embed Minimum Wage directly into your product

Minimum Wage Finder API integration

The API is great for HR and payroll software companies looking for the most accurate minimum wage determination for a clients’ employees and for large employers wanting to appropriately set up new employees’ compensation or audit the minimum wage rates of existing employees. Incorporates minimum wage rate data directly into your HR/payroll system or application via JSON.

"rates": [

{

"authority_type": "State",

"state": "California",

"rate": "55.58",

"effective_date": "2024-01-01",

"industry_type": "Computer Professionals",

"details": "Minimum hourly rate of pay exemption from overtime amount for Computer Professionals",

...

},

{

"authority_type": "Federal",

"rate": "27.63",

"effective_date": "2017-01-01",

"industry_type": "Computer Professionals",

"details": "Minimum hourly rate of pay exemption from overtime amount for Computer Professionals",

...

},

...

]Portal

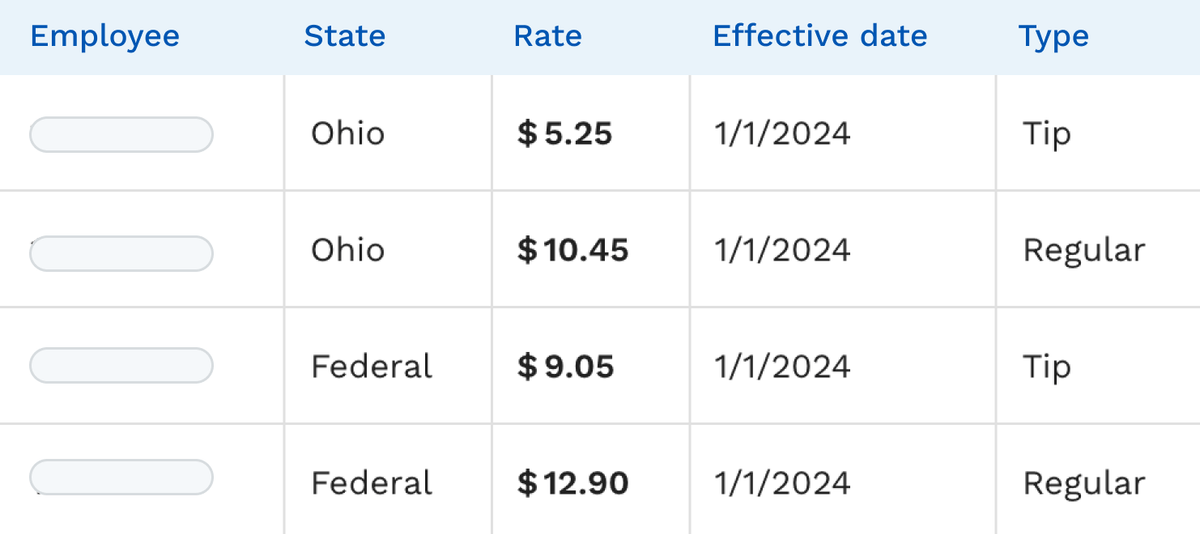

Ideal for payroll and human resources professionals to identify minimum wage rates for employees with geospatial visualizations. Allows you to confirm wage rates are in compliance as a position is posted or apply rates precisely rather than on expectation. See rates across all industry and job-type categories.

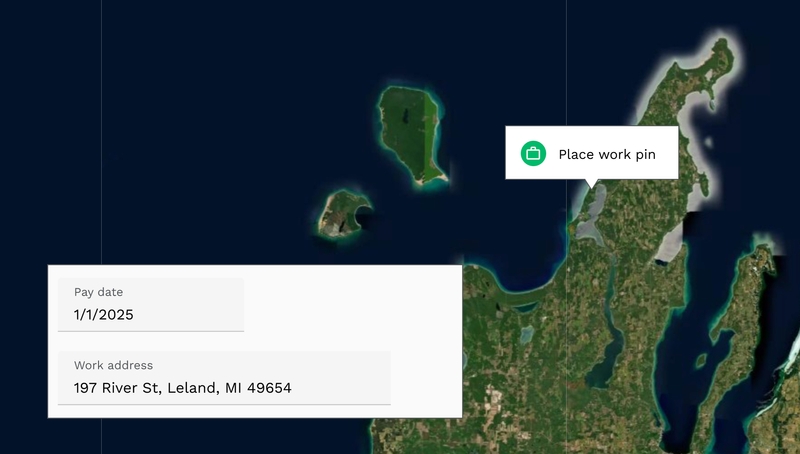

Portal Maps

The Maps interface identifies wage jurisdictions with geospatial visualizations, making it quicker to research complex wage scenarios.

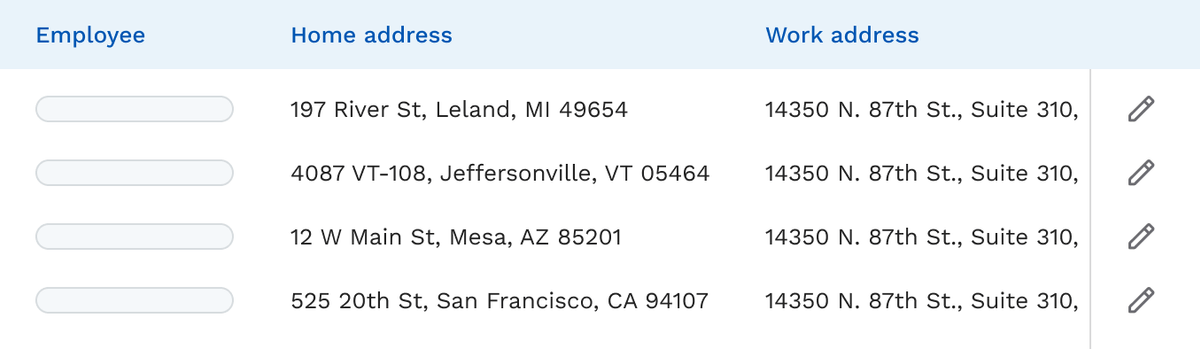

Portal batch

The batch feature allows corporate users to process a large group of addresses - great for audits of your compensation data and data clean-up in your payroll system.

FAQ

Contact us if you don't find your question answered here about Minimum Wage Finder.

Get started

Looking for more?

Symmetry Payroll Point

Determines complicated local withholding tax rates within your product by applying latitude and longitude coordinates of a residential address and a work address against Symmetry’s expansive library tax shapefiles, nexus and reciprocity algorithm.

Symmetry I-9

Fast, compliant I-9 verification software for onboarding and payroll providers. Offers all Section 2 verification methods (including remote) and full E-Verify integration.

Symmetry Payroll Forms

Directly integrates and automates the withholding forms process at the federal, state, and local levels with over 130 compliant forms.