Tax Logic AI: Instant Payroll Transparency

Introducing Tax Logic AI, Symmetry’s 24/7 expert. Eliminate manual research, achieve 98% faster resolution, and ensure audit-grade accuracy on complex tax calculations.

The complexity of payroll tax calculations often leads to time-consuming manual research and support cycles. For technical teams —engineers, product managers, and tax compliance analysts— the logic behind compliant tax withholding calculations has long been a black box. What if you could have immediate, transparent, and accurate explanations for every complex payroll tax withholding?

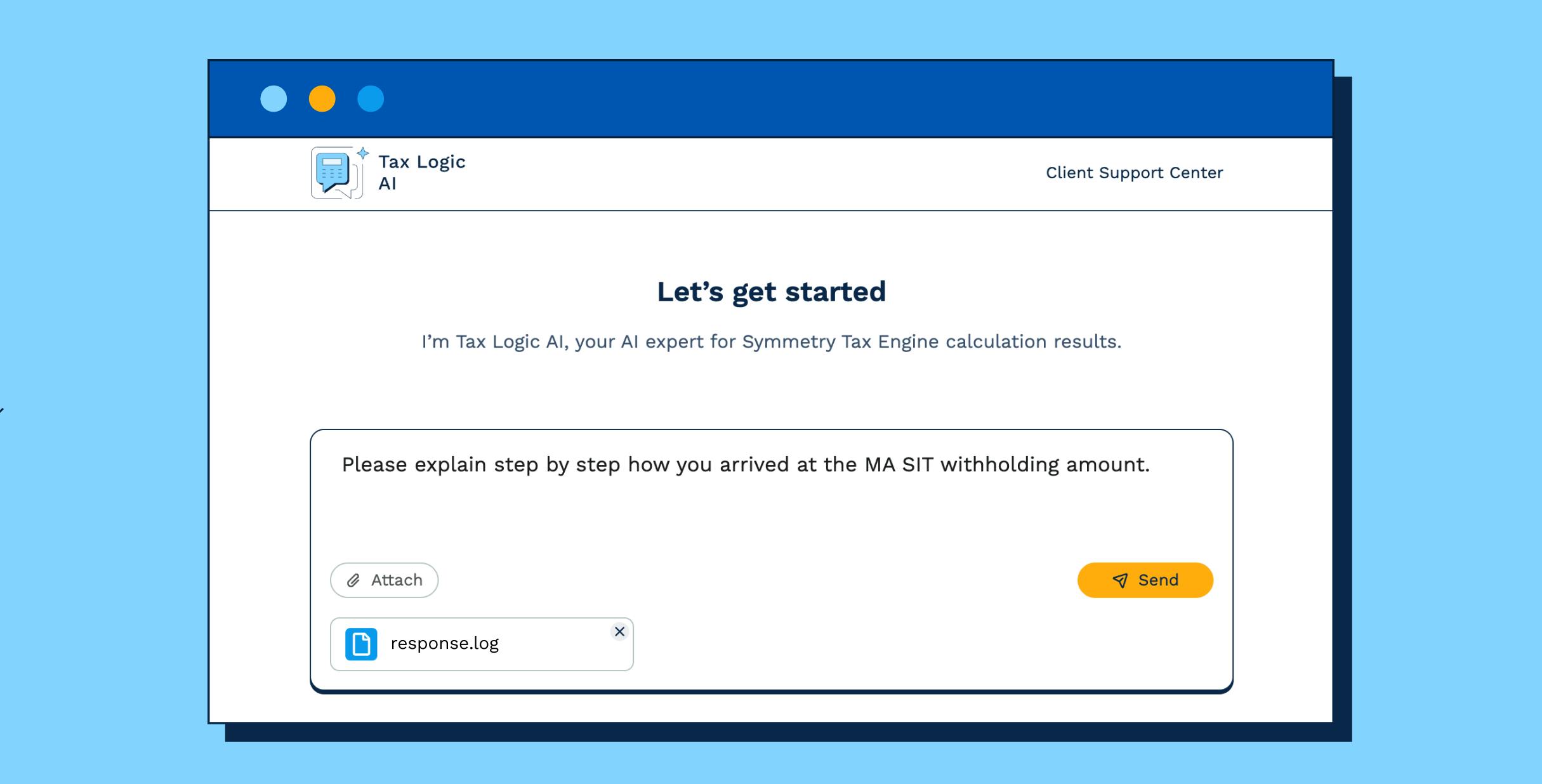

Symmetry is proud to introduce Tax Logic AI, our intelligent AI platform that serves as your 24/7 tax research expert. While the Symmetry Tax Engine® (STE) delivers the correct payroll calculations, Tax Logic AI provides the immediate, clear, and concise tax interpretation you need. It empowers your teams to confidently answer and resolve tax inquiries in real-time with clear, step-by-step calculation explanations.

Proven AI Platform for Payroll Tax Compliance

Tax Logic AI is a powerful tool designed to accelerate and validate your team’s expert work, ensuring maximum compliance.

Elevate Your Experts

Use Tax Logic AI to automate repetitive, manual tax research. This frees up valuable expert time to focus on complex legislative analysis and proactive product innovation.

Ensure Audit-Grade Accuracy and Defensibility

The platform creates a defensible paper trail by instantly generating documented logic behind complex calculations. This capability significantly reduces the time and effort required to respond to tax authority audits and internal compliance requests.

Validate Tax Changes Rapidly

Tax Research Teams can use Tax Logic AI to rapidly test and confirm that proposed tax changes or system enhancements meet all regulatory requirements.

Case Studies: Full Forensic Analysis of Any Payroll Tax Scenarios

Tax Logic AI utilizes your gross-to-net calculations to provide a full forensic analysis of the result, offering unprecedented transparency. This capability helps solve some of the most intricate payroll scenarios:

1. Multi-State/Local Tax Reciprocity

Understanding municipal tax rules, especially when employees live in one city and work in another, can be confusing. Tax Logic AI explains the complex interplay of resident and work taxes, including the application of credits.

2. Resolving Year-to-Date (YTD) Tax Differences

Taxes with annual wage bases, like Social Security (FICA), can sometimes require “Year-to-date” balancing to ensure the correct amount has been withheld by the end of the year.

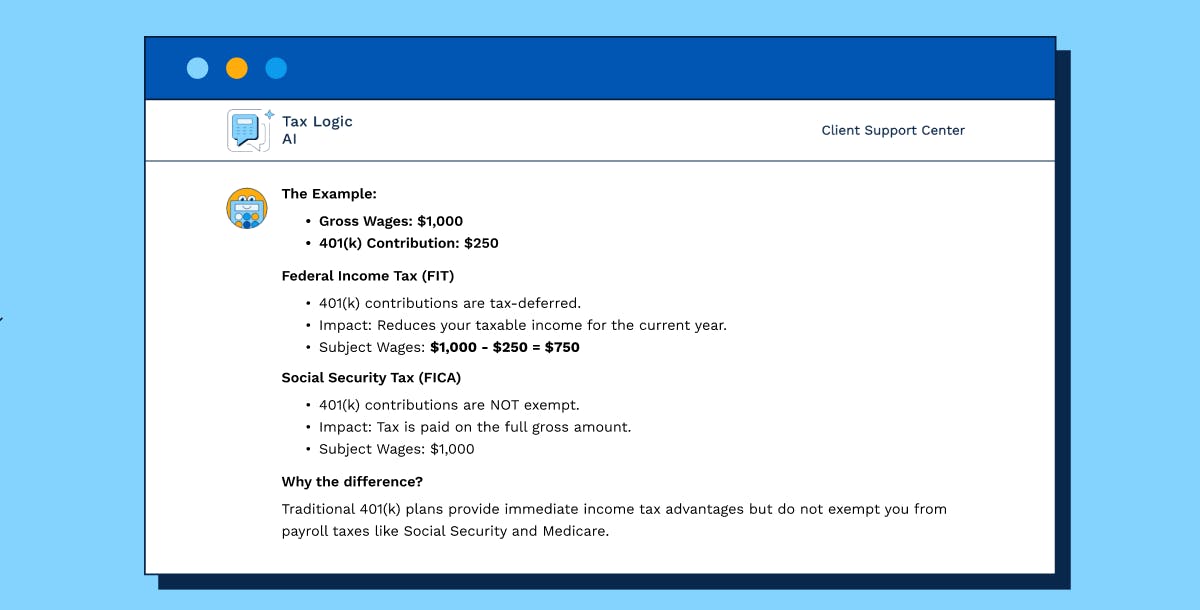

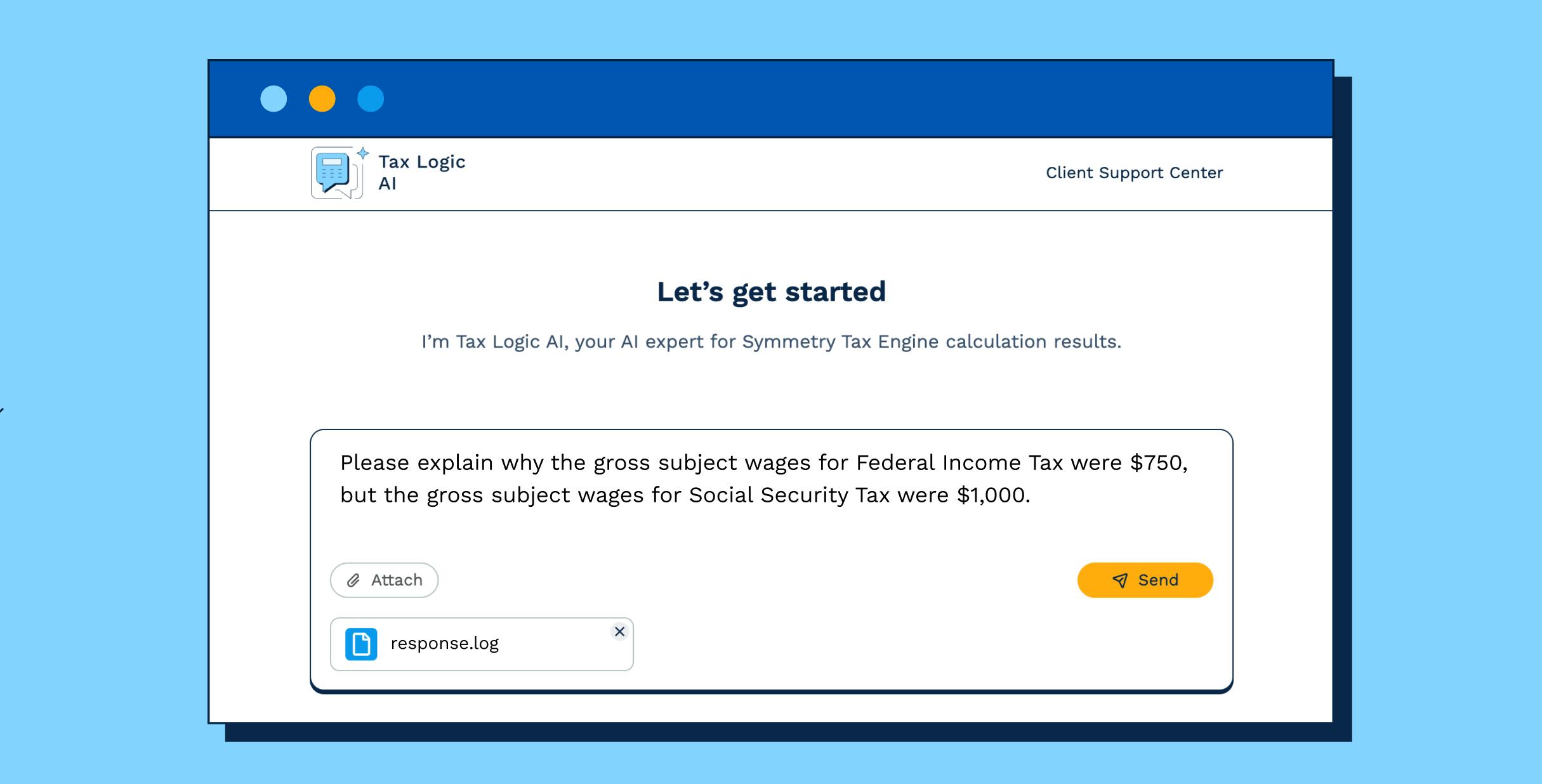

3. Understanding Benefit Taxability

Different taxes treat benefits like 401K contributions differently (pre-tax vs. after-tax). Tax Logic AI quickly clarifies how taxable wages were determined based on contributions to different benefits for each tax

Tax Logic AI is already delivering significant value, cutting down research time and accelerating problem resolution:

"The AI agent is a nice feature that provides very quick feedback and helps us debug complex issues and identify bugs, helping us rapidly diagnose everything from parameter errors to user misinterpretations, ultimately increasing our productivity and reducing the need for support requests.”

Powered by Symmetry's proprietary tax logic and industry-leading database of tax rules for 7,040 taxing jurisdictions and U.S. territories, Tax Logic AI is the essential tool for transforming manual tax interpretation:

- Achieve 98% faster resolution for support time

- Deflect 74% of escalated tickets

- Resolution Time: less than 1 minute

Deliver the tax logic clarity your teams need

Tax Logic AI is the most effective solution for technical teams needing tax logic clarity. It’s the essential tool for transforming manual tax interpretation into automated, confident expertise.

Ready to empower your team, accelerate product innovation, and streamline your tax compliance processes? Tax Logic AI delivers the certainty you need. Book your Tax Logic AI demo.

Who is Tax Logic AI for?

Symmetry’s AI platform is built for teams needing tax logic clarity: Engineers, Tax Compliance Analysts, Support Representatives, Payroll Managers, and Product Managers. Anyone seeking a clear explanation of a specific tax withholding result will find it invaluable.

Can I ask questions without a Symmetry Tax Engine (STE) log file?

Yes, but the accuracy will be lower. Tax Logic AI uses the uploaded log file to precisely recreate the full tax calculation within the Symmetry Tax Engine (STE), which guarantees the most reliable, context-specific results.

How up-to-date is Tax Logic AI with tax regulations?

Tax Logic AI utilizes the latest version of the Symmetry Tax Engine (STE). This means it incorporates the latest tax regulation updates and knowledge immediately upon release.

Why can’t I just use a public AI tool like ChatGPT or Gemini?

Public tools rely on generic, publicly available tax compliance data. Tax Logic AI, however, has exclusive access to Symmetry’s dedicated tax research and proprietary calculation logic of the Symmetry Tax Engine. Symmetry’s AI can accurately diagnose configuration issues and explain how a specific result was derived, which public tools cannot do.

How is data secured?

Tax Logic AI The platform processes log file payloads for explanation via encrypted API communications.