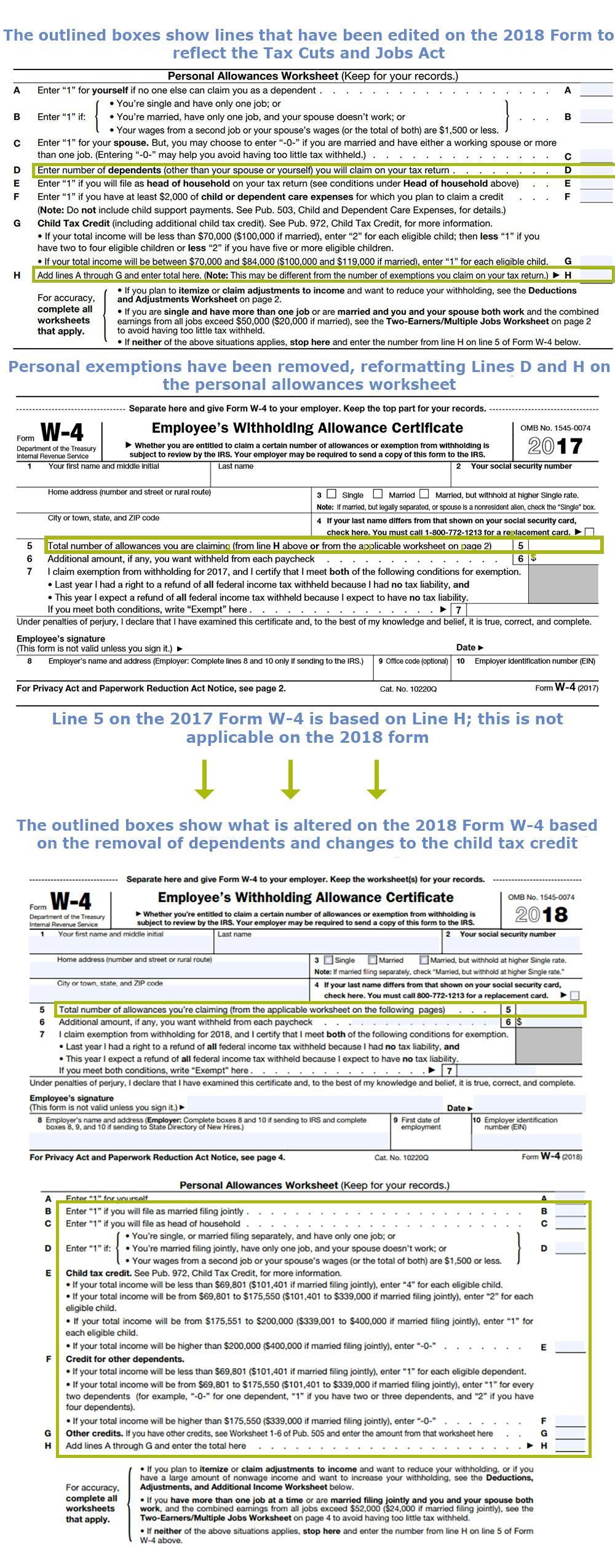

What's New on the 2018 W-4? [Infographic]

The 2018 W-4 eliminates personal and dependent exemptions the new law enhanced the pre-existing child tax credit.

![What's New on the 2018 W-4? [Infographic]](https://images.prismic.io/symmetry/fbf23c31-955b-4462-ac64-8374320dd1d5_W4.jpg?auto=compress%2Cformat&fit=max&w=1200&h=800)

The Tax Cuts and Jobs Act passed in December 2017 made considerable changes to tax withholding. Personal and dependent exemptions are no more and the new law enhanced the pre-existing child tax credit.

The personal allowance worksheet reflects these effects, adjusting Lines B through H extensively. Line D on the 2017 form specifically references the number of dependents a person can claim on his or her tax return - which, as mentioned, tax reform eliminated. Line H on the 2017 form is an accumulation of lines A through G - which indicate dependents and the child tax credit. On the 2018 form, Line E outlines the child tax credit, which has updated requirements.

Take a closer look at the differences in the infographic below. The most important pieces have been outlined in green boxes.

If you like this article, you may like Important Information Regarding Form W-4 for 2018.