6 Common Payroll Tax Problems and How to Solve Them

The six most common payroll tax problems for people tech providers are calculating taxes across multiple states, maintaining compliance, classifying workers properly, determining accurate paycheck withholdings, accurately calculating employers’ tax payments, and protecting payroll data.

If you’re building a payroll product for your people tech platform, you need to ensure your payroll calculations are accurate and compliant. But successfully navigating the world of payroll taxes can be time-consuming, stressful, and complex, and payroll tax issues often spring up when you least expect them.

“Managing payroll taxes can be tricky, and it’s easy to make mistakes—like failing to report all eligible taxable compensation or missing local districts’ tax updates. Plus, the requirements are always changing, making it even more challenging to stay on top of things.”

Though payroll taxes come with many challenges, mastering the most prevalent challenges can help give you a significant leg up when it comes to payroll tax compliance. Typically, people tech providers face payroll tax challenges in six categories:

- Calculating multi-state and multi-jurisdiction payroll

- Maintaining compliance

- Worker classification

- Determining accurate withholdings

- Calculating employers’ tax payments (and remitting them on time)

- Safeguarding sensitive company and employee data

Whether your payroll platform serves businesses that are small or large, with workers in one state or many, you’re bound to run into payroll tax complexities that create hurdles for you and your customers.

Thankfully, you don’t have to face these hurdles alone. With the right payroll tax compliance infrastructure, you can win back more time to do what you do best: build remarkable people tech products that drive efficiency and performance for your customers and set you apart from your competitors.

Challenge 1: Calculating payroll taxes for multiple jurisdictions

With the proliferation of multi-location businesses and remote and hybrid work, you’re likely responsible for calculating payroll taxes for customers employing people living in different states, provinces, counties, cities, and towns. Having to account for multiple tax jurisdictions makes payroll tax and withholding calculations even more complex, and laws, regulations, rules for compliance, and payroll tax liabilities can (and often do) change every year.

Ask any payroll provider, and they’ll tell you that handling multi-jurisdictional and multi-state payroll taxes is incredibly difficult. With thousands of tax jurisdictions to manage and constant changes to keep up with, it's so easy to make mistakes. You need to know where your customers have nexus or reciprocity, and some of these jurisdictions are so small that you might have to call the local government directly to get updates.

Thankfully, a reliable compliance infrastructure provider can handle these calculations for you, freeing up time and energy for other, more important aspects of your platform. For example, the Symmetry Tax Engine (STE) calculates taxes securely, intelligently, and quickly for all 50 states, Puerto Rico, US territories, and over 7,400 local tax jurisdictions.

Challenge 2: Maintaining compliance at all times

Payroll tax calculations, tax laws, and reporting requirements change frequently across different jurisdictions. However, that’s never an excuse for non-compliance. As your customers' trusted payroll provider, it’s your responsibility to keep up with the latest tax changes at the federal, state, and local levels to ensure your payroll tax calculations are always compliant and accurate.

One way to stay on top of tax changes is to build out a large compliance team to manually track them. It’s a labor-intensive, time-consuming, and expensive undertaking.

Alternatively, you can build your payroll product on Symmetry's compliance infrastructure. It will do the heavy lifting for you by instantly calculating payroll taxes in accordance with your employee information and the latest tax rules. Our compliance team keeps up with all payroll tax regulations, and our software is regularly updated, so you don't have to worry about incorrect calculations or compliance. What’s more, Symmetry notifies you proactively of any and all tax changes and how we updated our platform to account for them, so your team stays just as in-the-know as ours.

In short, you can rest easy knowing your product is built on the most accurate, up-to-date payroll tax data—not outdated information.

Challenge 3: Worker classification

Even if you do everything right, there are some payroll factors that might be beyond your control. Worker misclassification is a common—and costly—mistake your customers might make, and it’s on you to guide them to classify workers properly and file the right forms.

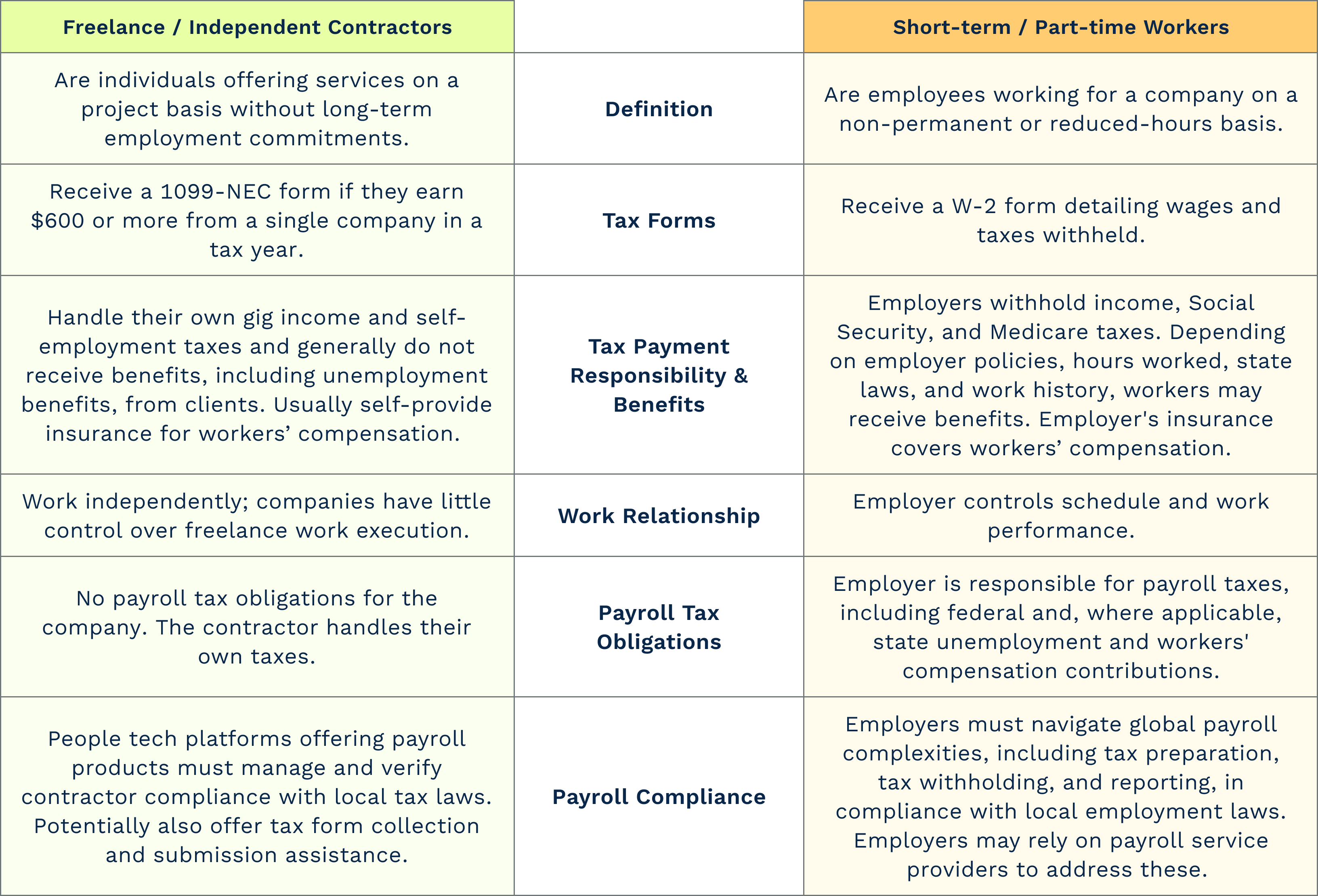

For instance, there are clear differences between employees and independent contractors, and they need to be categorized appropriately to comply with US tax regulations.

Difference between freelance contractors and short-term and part-time workers

Simply put, worker classification is crucial, especially in the tax landscape. If you’re an early-stage startup in the people tech space, just know this: misclassification is an oversight your customers—and you—can't afford.

Challenge 4: Determining accurate withholdings

It goes without saying that withholding the proper taxes from employees’ paychecks is critical to your payroll product’s success. Incorrect withholdings can leave employees paying significantly more or less than they are required to by law, which can cause unwelcome surprises for employees when they file their returns and spell financial trouble if they are living on a tight budget. Ultimately, this can cause employees to feel frustrated with their employer when they are made aware of the errors. In turn, employers will become frustrated with your product.

The challenge lies in the fact that accurate withholdings are more complicated than asking employees to fill out a federal W-4 and withhold accordingly. For starters, you have to ensure that all employees receive the correct withholding forms, not just at the federal level, but at the state and local levels, too. That said, not all states require employees to submit W-4s, such as states that don’t levy income tax. Other states don’t have a separate withholding form and accept the federal W-4 instead.

There are also different withholding forms for nonresidents, both at the federal level and for some states. Then there are different withholding forms for military personnel and their families. It’s up to your payroll product to know which employees are subject to which forms and to help employers get said forms to employees at onboarding or whenever they want to change their withholding status.

From there, your payroll product is responsible for synthesizing data from employees’ withholding forms with complex payroll tax regulations across thousands of jurisdictions and then calculating proper withholdings per employee. It’s a complicated process in general, but even more so when your customers employ workers in many states and even countries.

Working with a compliance infrastructure provider like Symmetry that offers withholding form and payroll tax calculation solutions, can relieve your team of these significant challenges, even on a global scale. In addition to accurately calculating federal, state, and local withholding taxes for more than 7,400 US taxing jurisdictions, the STE covers Canada and solves for global payroll tax complexities like mobile employees working in the US who are federal income tax or FICA exempt.

Challenge 5: Calculating employers’ taxes

Calculating and withholding the proper payroll taxes and remitting those tax payments—especially your customers’ share—to the Internal Revenue Service (IRS) and state and local governments on time are also major challenges for payroll providers. That’s because, as previously mentioned, the rules and rates impacting employment taxes and payment schedules are in constant flux. And in some cases, your customers are on the hook for paying employees’ share of taxes, too.

As your customers' payroll provider, that makes you responsible for managing more than just federal, state, and local income taxes. You also need to handle various employment taxes, such as:

- Federal Insurance Contributions Act (FICA), which funds Medicare and Social Security programs

- Federal Unemployment Tax Act (FUTA), which covers unemployment payments for employees who lose their jobs, with taxes paid solely by the employer

- State Unemployment Tax Act (SUTA), which funds unemployment benefits at the state level

The rules governing these taxes vary not only from state to state but also change frequently as state and local governments pass new legislation. These changes can impact areas like paid family and medical leave, which you need to keep track of for your customers.

If you include minimum wage compliance in your payroll tax product, there's even more to monitor. For example, in 2024 alone, 22 states increased their minimum wage requirements, adding to the many non-uniform tax law changes your payroll product must account for.

Failing to pay payroll taxes on time can lead to significant penalties for your customers, similar to those for misfiling or not filing payroll tax forms—and they also risk incurring liens. Local and state tax offices, as well as the IRS, impose their own penalties for unpaid or incorrect payroll tax payments, which can result in tax debt and hefty fines.

Challenge 6: Safeguarding payroll information

As a payroll provider, it’s your duty to safely transfer and store large amounts of sensitive data, both about your customers and their employees. You’re responsible for maintaining payroll records containing birthdates, home addresses, phone numbers, Social Security numbers, and more.

What’s more, protecting payroll information isn’t just an ethical responsibility; data privacy and protection laws, like the Federal Trade Commission’s Safeguards Rule, legally require you to handle sensitive data with care. If you fail to comply with the Safeguards Rule, the FTC could investigate your business, potentially resulting in hefty fines.

So, how can you address this? First, secure your physical business locations. Then, perform a cybersecurity audit of your digital solutions and review how your team handles information.

Here are a few, high-level questions to consider as you dive in:

- When was the last time someone reviewed your network settings? Who has access to what systems, and what are their permissions?

- Is sensitive data only accessible to staff members who must handle that data to deliver essential payroll duties?

- How is sensitive data accessed? How secure are those access methods?

- If you use a payroll tax calculation partner, do they store sensitive employee data? Or do they use data only as needed, without storing it, in order to reduce risk?

- What technology solutions do you use? Do they use best-in-class security standards?

- Are all of your solutions updated to the latest, most secure versions?

- Has your staff been trained with the latest best practices in cybersecurity?

Work with a compliance partner with deep industry expertise

We know all this information is a lot to process—but it’s not all on you. With the right infrastructure in place, you can securely, compliantly, and seamlessly navigate payroll taxes for your customers.

Symmetry can handle the complex task of accurately calculating payroll taxes so you can serve your customers effectively, efficiently, and compliantly. Our products can help you supercharge your payroll product, freeing you to focus on innovating in the people tech space.