What is an Employer of Record (EOR)?

An employer of record (EOR) is a third-party organization or people tech provider that legally employs workers on behalf of its customers, i.e., other businesses.

We’re living in a time of ongoing changes to laws and regulations designed to protect employees. What’s more, businesses need to be able to scale globally—and fast—while hiring has never been more competitive. With so many material changes in so little time, it can be difficult for companies (i.e., your customers) to keep up.

Thankfully, people tech providers like you can step in as an employer of record (EOR) to help companies quickly enter new markets and onboard employees, regardless of whether they’re permanent, temporary, or seasonal. In 2022, the global EOR market was worth around $1.89 billion. And it's projected to grow at an annual rate of 12.07%, potentially doubling to $3.75 billion by 2028.

But offering EOR service within your people tech platform is more than a smart move; it’s a significant responsibility. Let’s dive into what that entails.

How does EOR work?

Typically, an EOR is a people tech provider who forms a legal entity to serve as the official legal employer of their customer’s (i.e., a business’s) employees in countries where the customer isn’t legally operating but has hiring needs.

Specifically, an EOR meets all legal and regulatory requirements through steadfast, ongoing compliance on behalf of the customer in the countries where the customer’s workers are employed.

This means that as an EOR, you’ll take on duties concerning payroll, benefits, contracts, HR, hiring, and offboarding, while your customer will be in charge of employees’ job responsibilities, compensation decisions, and ongoing career growth.

For example, imagine you have a U.S.-based customer with a unique project that requires hiring someone in Canada. However, they aren't set up to handle payroll or employment in Canada. Canadian payroll tax deductions, credits, benefits policies, and other legal regulations differ significantly from those in the U.S. and can vary by province.

Plus, setting up a Canadian legal business entity just to employ one person is costly. That's when they turn to you, their people tech provider, for EOR services. With your help, they can hire the candidate and get them onboarded legally and quickly while ensuring compliance with Canadian payroll laws—all without getting into the complexities of business entity registration and setup with federal and provincial governments.

Notably, as an EOR, you would carry most of the liabilities that an employer would have when employing individuals. So, really, your customers have a lot to gain.

Why businesses retain employer of record services

There are many reasons why your customers might begin outsourcing their payroll and other employer responsibilities to your company. With the right pricing and trusted, flexible support, you can offer your clients plenty of perks, including:

- Streamlining international payroll with automated, end-to-end services, especially to support customers’ global expansion or following a merger or acquisition

- Helping your customers legally and compliantly hire candidates in a new country, which is particularly useful if your customers are expanding internationally

- Reducing payroll compliance risks and administrative costs for your customers

- Simplifying the recruiting, hiring, onboarding, retention, and off-boarding of international employees—bringing greater efficiency to their operations

- Freeing up your customers’ HR team’s time so they can shift their focus to more high-impact, strategic initiatives

Simply put, becoming an EOR is an excellent way to help innovative customers scale faster and do what they do best in a cost-effective way. By outsourcing all their HR and payroll functions to you, your customers can instead spend their time, funds, and energy on mission-critical projects within their domain expertise. On paper, you play the role of employer, while your customers work closely with staff for the essential aspects of their duties: training new hires, executing major projects, managing daily responsibilities, developing careers, and more.

But what are the duties that come with such an important role?

What are your responsibilities as an employer of record?

As stated previously, as an EOR provider, it’s your duty to provide valuable, trusted, third-party people tech support, including payroll, benefits, and compliance with local employment regulations. It’s a role that comes with a lot of responsibilities, as non-compliance can lead to serious consequences and penalties—from security breaches and fines to incarceration, depending on the country and degree of non-compliance.

Potential penalties vary based on the local, state, or federal law or regulation at hand and the severity of the issue. Under the Canada Labour Code, for example, employers can be subject to Administrative Monetary Penalties (AMPs) ranging from $0 to $100,000 per violation, depending on the severity, their compliance history, the size of their business, and whether they voluntarily disclosed the violation.

For instance, failing to retain documents (a "Type A" violation) incurs lower penalties, while failing to provide a workplace free from abuse (a "Type C" violation) results in higher fines and potential hiring restrictions. Repeat offenders face increased penalties, and small businesses generally receive lower fines.

Under Canada’s Employment Equity Act, employers can face fines of up to $10,000 for a single violation and up to $50,000 for repeated or ongoing violations, such as failing to file reports or providing false information.

As you can see, an EOR has serious responsibilities surrounding finance, taxes, compliance, data security, and many other areas of business. Typically, EORs have local expertise and are knowledgeable about federal, state, and local labor laws and regulations. The best providers are also excellent communicators, adept at securing sensitive data compliantly, and they use leading tech solutions like the Symmetry Tax Engine (STE) to ensure payroll tax compliance at all times.

Responsibilities towards customers

As we’ve covered, EORs carry a host of legal, tax, and HR tasks and responsibilities, including:

- Managing, paying, and reporting payroll taxes for customers and their employees based in various countries, states, and local jurisdictions

- Managing employment contracts and paperwork for international hires’ employee visas and sponsorships

- Taking measures to avoid employee misclassification, which involves managing employee hours, employee benefits, health insurance, and paychecks

- Maintaining ongoing compliance with local labor laws and any surrounding requirements, including mandatory federal, state, or local training requirements

- Managing any claims for worker’s compensation and unemployment—or any similar insurance, depending on the country of employment

- Conducting or facilitating background checks for potential new hires

- Maintaining and safeguarding records and personal employee data

And this list isn’t all-encompassing. There are a host of other responsibilities and standards that you have to keep up with to ensure your customers feel confident that their new international employees and existing workforce will be in great hands.

The difference between an EOR and a professional employer organization (PEO)

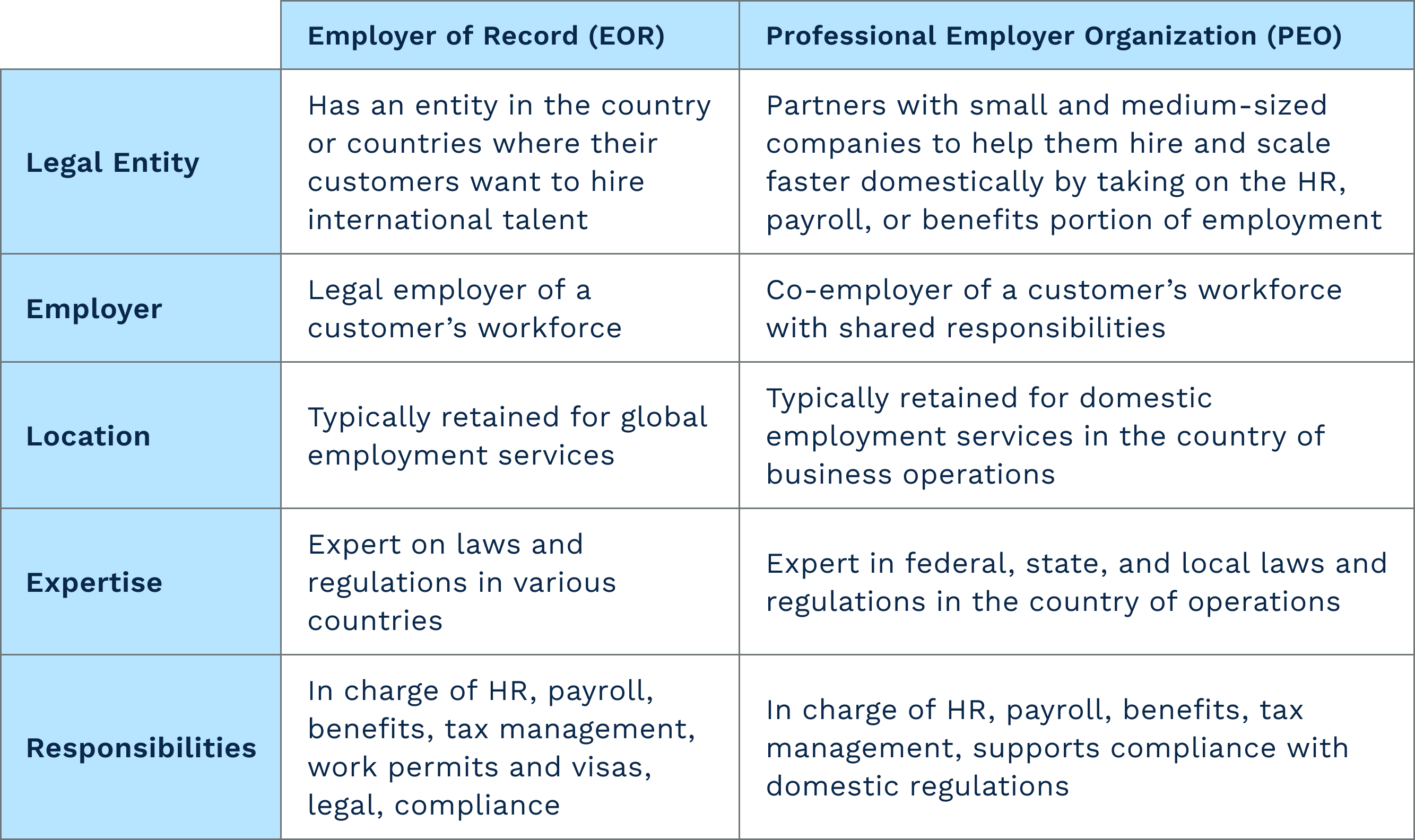

The greatest difference between an EOR and a PEO is that a PEO serves as a domestic co-employer, meaning it shares its customers’ employer responsibilities. Meanwhile, an EOR is the sole, legal employer of a company’s global workforce on paper and for all intents and purposes, helping customers hire, retain, and offboard international talent while remaining compliant.

Here are some more significant differences between EOR and PEOs:

Key differences between EOR and PEO

A note on independent contractors

As an EOR, you’re legally responsible for your customers’ global talent pool. However, that does not automatically extend to independent contractors because these workers aren’t employees. This means the contractors don’t receive benefits, and they are responsible for paying both the employee and employer share of social security and medicare taxes along with their income taxes. That said, while your customers working with independent contractors may not exactly need an EOR for these individuals, you can help them with international payments if your platform is set up to pay contractors in various countries. Deel, Gusto, and Remote are examples of people tech providers that offer this service.

So, if your customers would like to work with independent or freelance talent, they have the option of using your service as a people tech provider versus your employer of record service or paying them directly. In this regard, your duty is to help your customers ensure that they are not misclassifying employees as contractors.

The best people tech providers invest in their customers’ success

Offering EOR services is an enormous responsibility. Your customers need the right partner who can guarantee proper payroll tax management and ongoing compliance. There are numerous benefits for you, too, from expanding your product offerings and market share to building an all-in-one solution that gives you a competitive edge while boosting revenue.

And if you’re in the US, you might already know that Symmetry offers the best payroll tax compliance infrastructure on the market. By working with us, you’ll have a trusted partner right by your side to guide you through the process, ensuring compliance and security.

The STE can automate your payroll processing and cross-border payroll tax calculations in the US and Canada. Specifically, the STE can handle gross-to-net payroll tax calculations for federal, state, and local taxes in over 7,400 US tax jurisdictions (including payroll-related withholdings, employer taxes, and multi-state processing).

What’s more, with Symmetry’s Canadian Tax Engine, you can easily build cross-border payroll right into your people tech platform. Essentially, the STE can enhance your existing payroll product for greater compliance, accuracy, and ease—it’s a powerful, fast, innovative, and secure way to expand your payroll services internationally without introducing greater complexity into your business. For people tech startups, Symmetry can help you build payroll from the ground up–the right and compliant way–using our payroll tax infrastructure products, just like we did with today’s modern payroll juggernauts like Gusto, Rippling, Remote, and Deel.

Symmetry keeps up with all the latest tax updates and automates payroll tax calculations for industry-leading payroll platforms—and we can do that for you, too. By working with us, you can rest easy about the nitty-gritty of payroll tax calculations and focus on what truly matters to you: innovating your payroll product and creating exceptional customer experiences.