Payroll tax compliance

software for complete

accuracy & automation

Build accurate payroll tax calculations—from federal to local—plus minimum wage rates and automate your onboarding compliance with tax withholding forms, I-9 verification & more.

Powering every paycheck

"We quickly realized no one stacks up next to Symmetry. It didn’t take us long to validate and document that."

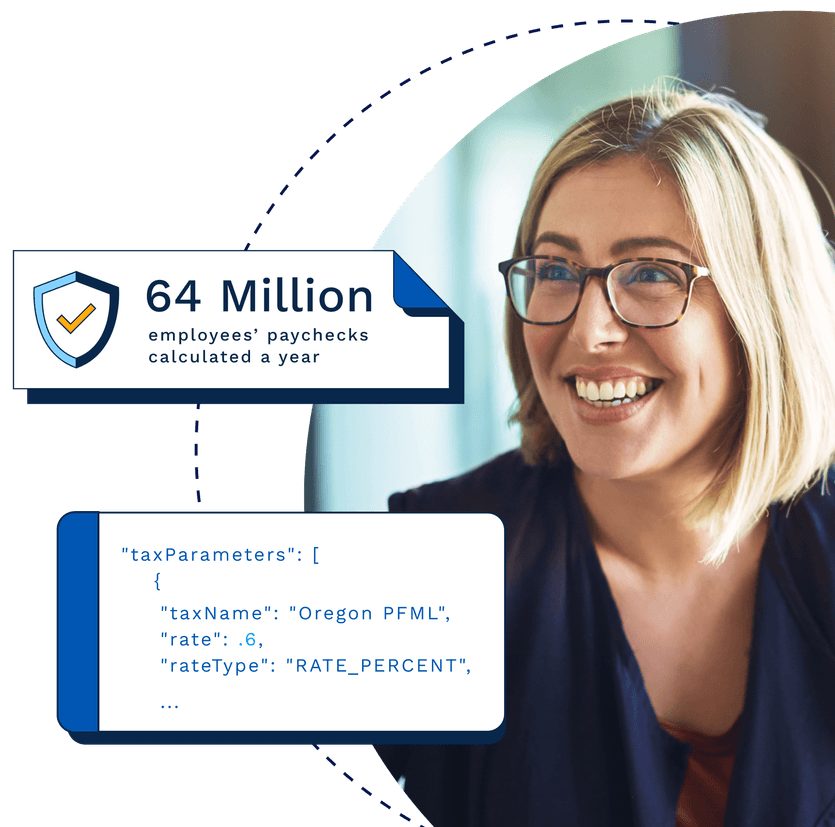

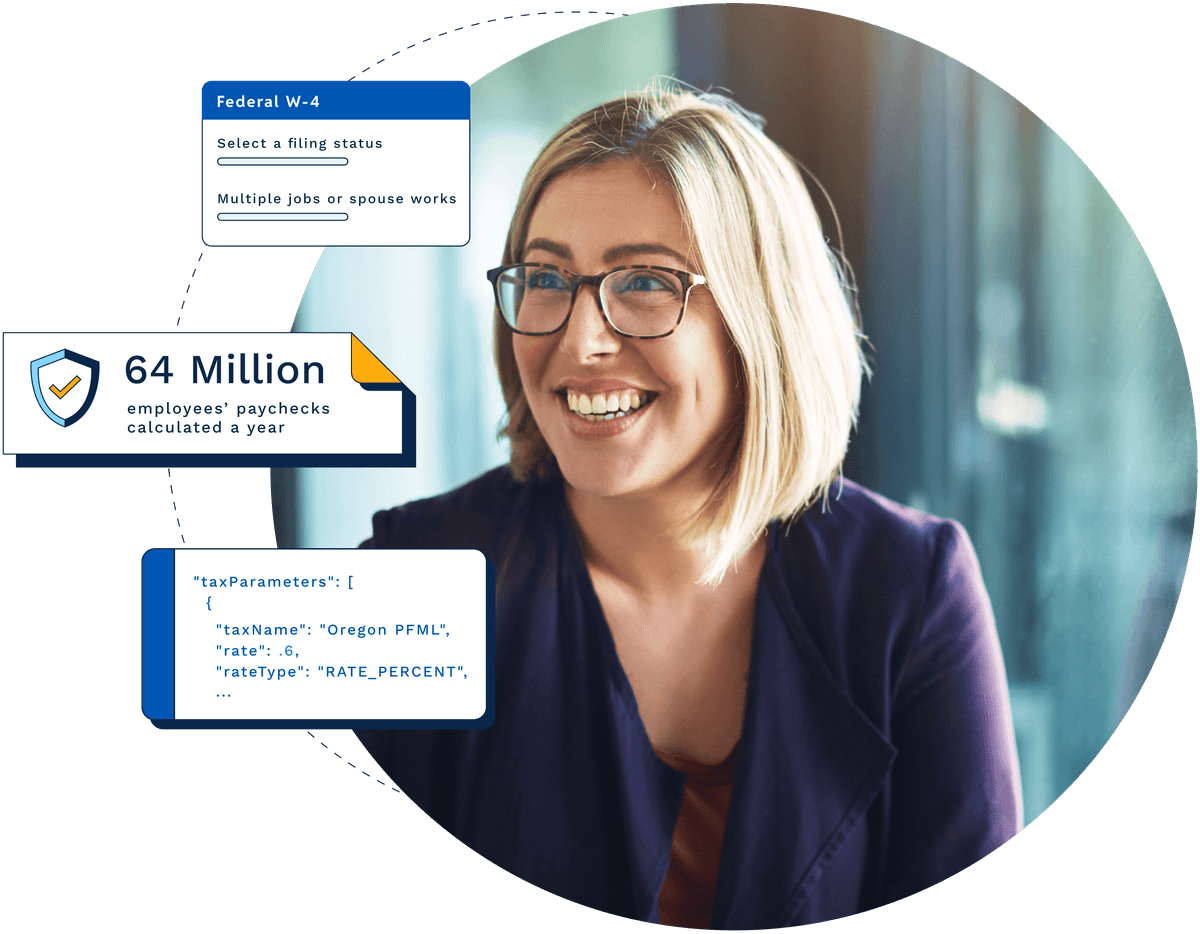

- 64 million+employees’ paychecks calculated each year

- 33 million+withholding forms processed each year

Powerful payroll tax compliance

software to build remarkable products

Symmetry's technology of payroll tax APIs and compliance software enables payroll platforms to ensure employee and employer taxes are accurately calculated.

From employee tax withholding forms to federal, state and local tax lookup and calculation software, we make every employer and employee process you build more automated, compliant, and error-free.

Symmetry Tax Engine

Calculate gross-to-net payroll taxes to build or enhance a payroll product, embed payroll into an existing application, and increase compliance.

Tax Logic AI

Symmetry’s 24/7 AI tax calculation expert. Eliminate manual tax research, achieve 98% faster resolution, and ensure audit-grade accuracy on complex tax calculations.

Symmetry Payroll Forms

Directly integrates and automates the withholding forms process at the federal, state, and local levels with over 130 compliant forms.

Symmetry I-9

Fast, compliant I-9 verification software for onboarding and payroll providers. Offers all Section 2 verification methods (including remote) and full E-Verify integration.

Symmetry Payroll Point

Determines complicated local withholding tax rates within your product by applying latitude and longitude coordinates of a residential address and a work address against Symmetry’s expansive library tax shapefiles, nexus and reciprocity algorithm.

Symmetry Minimum Wage Finder

Automated and accurate federal, state, and local minimum wage rates into your application by using exact location coordinates.

Payroll Tax Calculators by Symmetry

Embed or integrate over 11 payroll tax modeling calculators for any gross-to-net calculation or ‘what-if’ scenarios.

Symmetry Tax Notification Service

Tracks and alerts you of past, current, and future payroll withholding tax rate changes.

"Symmetry Software had a very detailed integration guide and a phenomenal technical staff that allowed us to get to market much quicker than if we had tried to tackle this on our own."

"We actually trot out Symmetry in our sales calls because it bolsters our credibility a lot. It supports how we can quickly get to work for the company with (tax withholding and) compliance all checked off."

Get a demo of Symmetry Software

Encouragement to speak to a payroll technology expert about solving tax compliance for your payroll process.